Feeding the Flames on Valentine’s Day

While the origins of Valentine’s Day are murky (the main schools of thought being the feast day of one of many Saint Valentines through history, the other being the Roman feast of Lupercalia which is far more sinister..), it is without doubt a major event in calendars around the world.

In the US alone, Valentine’s Day spending is expected to reach US$26 billion in 2024! That’s a lot of chocolates, flowers and marriage proposals. The day has also spawned or inspired a wide range of alternatives, copy-cats, piggy-backers and rivals – from Galentine’s Day in the US (for ‘gals’ and best friends), to Singles Day in China. In Japan, this antithesis shows up as White Day – held in mid-March when men reciprocate the presents they received from women on Valentine’s Day (yes, women are the main gift givers on the day in Japan..).

Likewise in Japan, Valentine’s Day is big business, particularly for the country’s confectioners. Representing over 20% of the country’s chocolate consumption (a market estimated at nearly US$5 billion in 2024), Valentine’s Day demand is insatiable and the competition fierce. The landscape is dominated by domestic Japanese chocolate brands like Morinaga, Meiji and Royce but international brands have also managed to make a firm foothold in the market – Lindt, GODIVA and Nestlé for example (particularly Nestlé’s KitKat brand which has become nothing less of a national treasure in the country).

With so much competition, chocolate brands need to have a pulse on how customer tastes are changing and how and where they can stay relevant and be top of mind when it’s time to purchase. We’ve been doing some digging and see three key areas that could be critical for chocolate brands to unlock new audiences and commercial opportunities on Valentine’s Day and elsewhere in the year.

1. Chocolate putting more focus on male audiences?

While chocolate products can typically be non-gender-specific or female oriented in most markets (although granted Snickers and Yorkie were not shy of shouting about their bars being for men), an interesting development is emerging in Japan – that of chocolate products focused solely on men.

In recent years, premium menswear and lifestyle brands in Japan have been expanding their reach into the chocolate space. The likes of Ron Herman, Dunhill and Ralph’s have identified a growing awareness amongst Japanese men of the apparent health benefits (anti-oxidants and polyphenols) of chocolate with high cocoa content.

These brands are releasing chocolate products not just to be given on Valentine’s Day but can be consumed at any time of the year as part of a daily health regimen. Some brands, including Glico’s product brand GABA are even focusing on specific male audiences – businessmen for example – and highlighting the stress relief that can be provided by eating chocolate.

GABA, the stress relieving chocolate from Glico

Success is starting to be seen for chocolate brands that have managed to tap into a male audience in innovative ways and through smart partnerships. Korean confectionary giant Lotte has a huge presence in Japan and has used its Ghana chocolate brand to build awareness and sales with younger male audiences. In 2020 the brand partnered with Eve, a massively popular anime music creator amongst younger males, where purchases of their products could win tickets to an Eve concert. An appetite by a wider range of chocolate makers in Japan to shift their lens to male audiences more specifically is yet to be seen but now could be the time to take a risk.

Ghana x Eve

campaign site

2. Self-gifting reflecting Japan’s societal challenges

Convention says gifts should be given to others but for all of us there are occasions where you want to ‘treat yourself’ – after a long day, a successful week or just a spontaneous, impulse buy. Self-gifting has been seeing an upward trend in Japan, with 86% of consumers making purchases for their own well-being, be it to lift their mood (43% of consumers) as stress relief (42%) or as a reward.

The reasons behind this may be highly complex but potentially reflect a number of the long-term societal challenges present in Japan today – stress in the workplace, increasing feelings of loneliness across demographic lines, and a decrease in economic opportunities. With Japan ranking lowest of any developed country in the United Nations World Happiness Report in 2022, self-gifting could be a response to these day-to-day experiences.

With gifting being a major activity in Japan (check out our piece on the changing habits of gifting in Japan) to the tune of over US$70 billion a year, how brands can better deliver on the wants and needs of consumers that want to gift to themselves is a big question. As Godiva Japan CEO Jérome Chouchan highlighted in our recent Eat Takeaway interview “It’s about ‘Let’s buy something for me’ or ‘Let’s buy something for tonight’. This all means different product sizes, packaging and price points”. The challenge will also be in striking the right and appropriate tone on a behaviour that potentially derives from negative roots.

3. A sustainability story on Valentine’s Day

The rate of consumers in Japan making brand or product choices not just on price or quality but on sustainability grounds is continuing to grow. A 2022 survey by Japan’s Consumer Affairs Agency found that more and more people in the country are putting their support behind brands and products that are operating ethically or engaging in SDG (Sustainable Development Goals) initiatives. 60% of consumers in fact, with nearly half of consumers wanting to purchase SDG-related products.

And this is being carried through to chocolate. Research conducted by chocolate manufacturer Barry Callebaut found that 70% of Japanese consumers link sustainable chocolate products to a sense of feeling good, better quality, trustworthiness and alignment with personal values. While it can be difficult to tie down any precise conversion from consumer sentiments or stated desires around sustainability to product sales, the trajectory seems to be in one direction as brands across the chocolate and gifting space develop new ranges with story-telling built on more sustainable sourcing and manufacturing.

In 2022 for example, Japan’s largest Valentine’s Day chocolate event – Amour du Chocolate – had the SDGs as its central theme. The event featured products that champion local Japanese ingredients to lower production emissions, as well as chocolate brands working with farmers in Indonesia that support biodiversity by planting cocoa trees alongside other plants, rather than a typical monoculture approach.

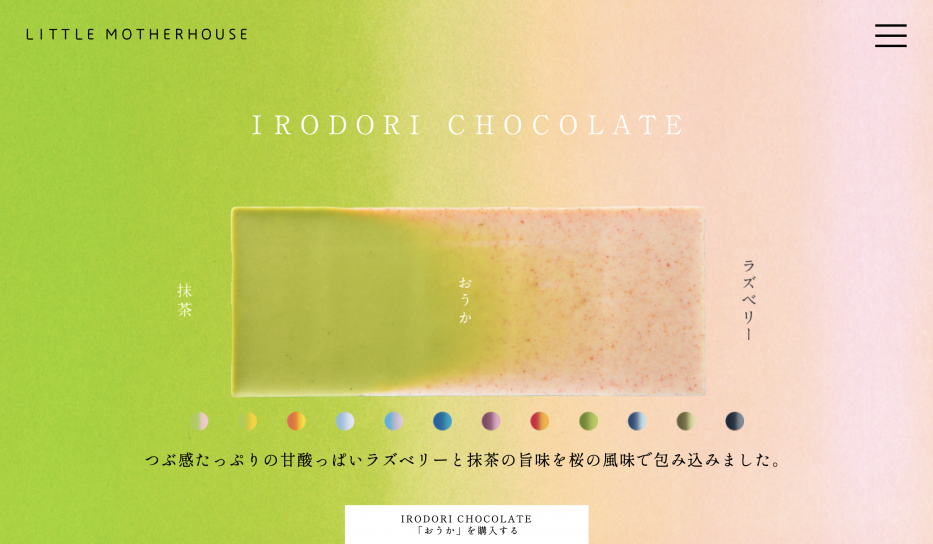

Featured at Amour du Chocolate's event, IRODORI CHOCOLATE from LITTLE MOTHERHOUSE uses cacao beans grown from agriculture methods that promote biodiversity

The

chocolate, and particularly Valentine’s Day, space in Japan is crowded and

competitive. But even in this mature market there are opportunities to innovate

and create new commercial success. From developing partnerships that can take

your brand or product to new audiences and lifestyle touchpoints (as Ghana did

with EVE), to embedding your brand in the public mindset on national holidays

(think KFC at Christmas), to engaging the younger

Japanese audiences that are spending more and more time in the virtual world, there is a lot to

explore. Valentine’s Day can be the time to take a risk and see your brand love

flourish.